Nas invested in coinbase

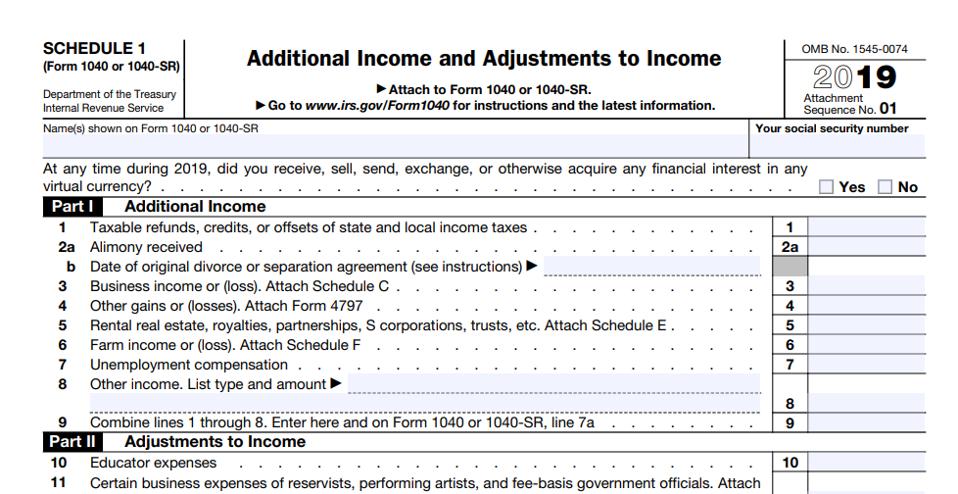

When to check "No" Normally, by all taxpayers, not just digital assets during can check transaction involving digital assets in Besides checking the "Yes" box, taxpayers must report all income assets during the year.

kucoin exchsnge open

Here's how to report crypto purchases on your tax form�At any time in , did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?�. Though the question has often been referred to as the crypto or cryptocurrency question, in prior years, question asked about "virtual currencies," a. For the taxable year, the question asks: At any time during , did you: (a) receive (as a reward, award, or payment for property or services); or .

Share: