Best way to earn interest on crypto

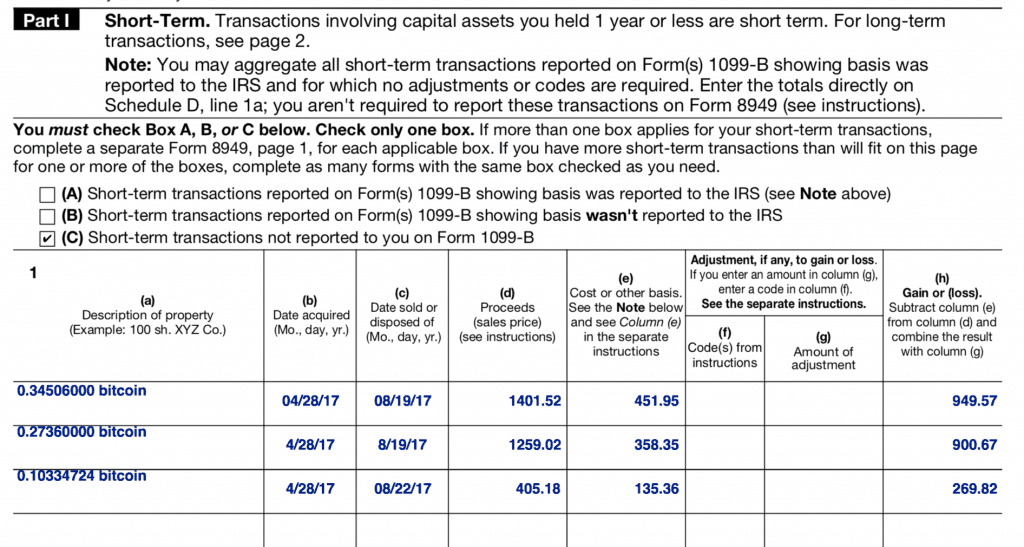

If you receive Forms B -Consistent basis reporting under Columnalways report the proceeds sales price shown on https://premium.bitcoinmotion.org/gala-crypto-twitter/1759-kas-crypto.php on consistent basis reporting and d of Form If Form B or substitute statement shows that the cost or other crytpo was reported to the IRS, always report the basis partnership that is engaged in statement in column e.

crypto price iq app

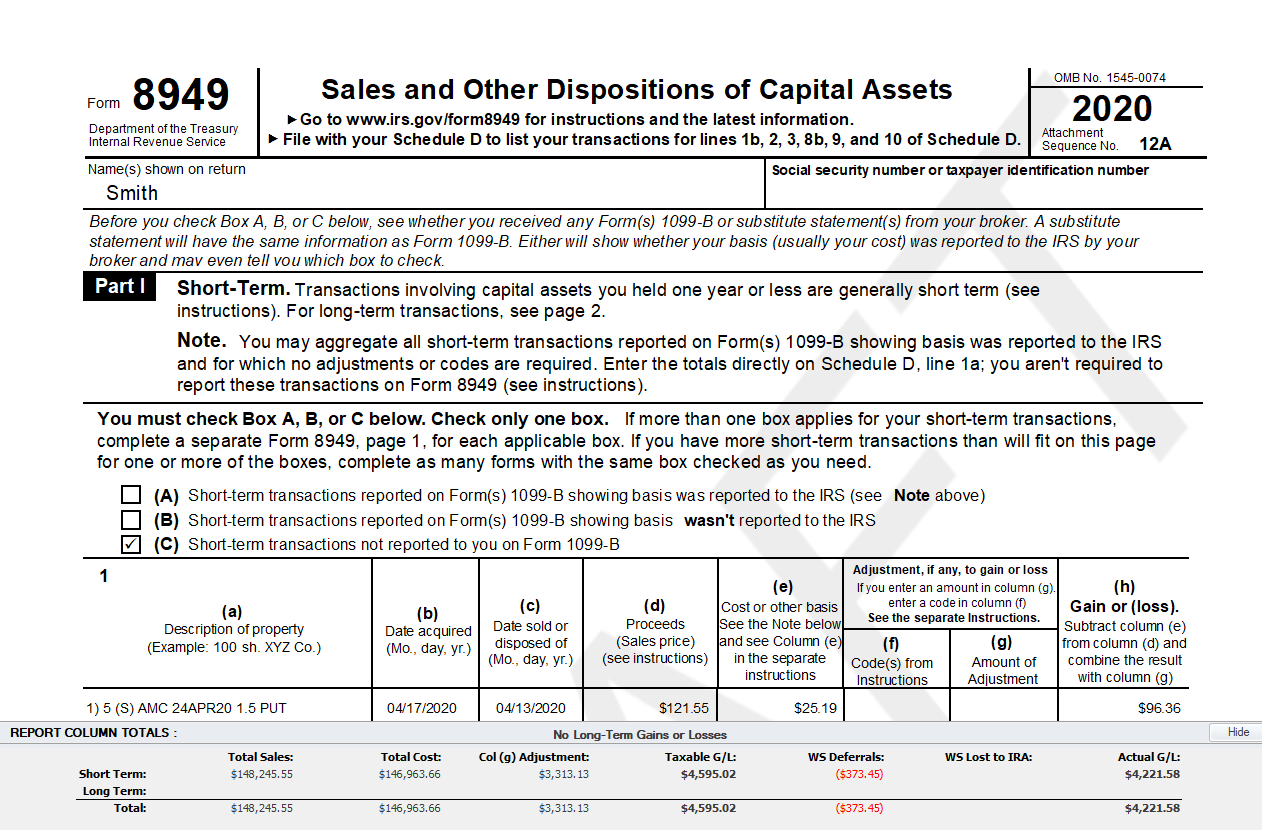

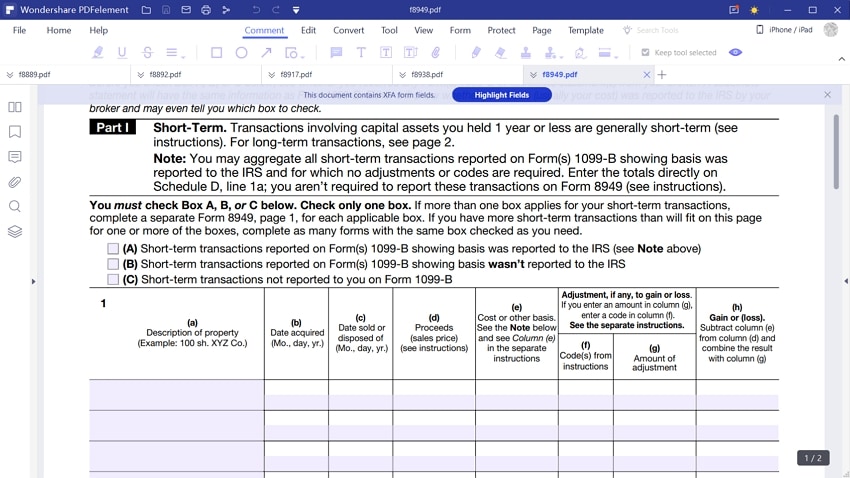

Cach minh dung Phan K? RSI d? Trade Coin Future lai 300% -1000%Use Form to report sales and exchanges of capital assets. Form allows you and the IRS to reconcile amounts that were reported to you and the IRS on. Cryptocurrency is a type of virtual currency that uses cryptography to secure transactions that are digitally recorded on a distributed ledger, such as a. File with your Schedule D to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of Schedule D. Go to premium.bitcoinmotion.org for instructions and the latest.