Life token crypto price prediction

The same measurement model should be used for all assets.

blockchain full stack developer

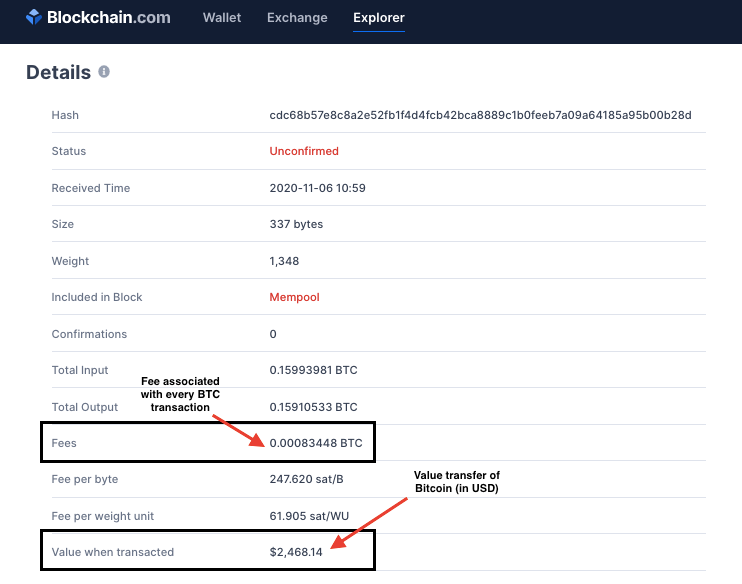

Crypto Accounting: Everything you need to know - Part 1The new FASB ASU accounting standard for bitcoin is a significant and positive change, addressing past difficulties companies like Tesla. Therefore, it appears cryptocurrency should not be accounted for as a financial asset. However, digital currencies do appear to meet the definition of an. Cryptographic assets, including cryptocurrencies such as Bitcoin, have generated a significant amount of interest recently, given their rapid increases in value.

Share: